Delve into the complexities of Michigan tax laws and uncover the key insights every business owner needs to know. Navigating the landscape of business tax compliance can be daunting, but with the right understanding of Michigan's tax regulations, you can position your business for success. This blog post sheds light on the common challenges faced by business owners and offers expert guidance to help you overcome them. Equip yourself with the knowledge to manage your business's tax obligations efficiently and ensure compliance with the state's unique financial landscape.

-

Navigating Michigan Tax Laws: Essential Insights for Business Owners

-

Navigating Michigan's Tax Landscape: Essential Tips for Business Owners

Are you a business owner in Michigan looking to navigate the complexities of the state's tax landscape? Our latest guide offers essential tips and insights on Michigan tax regulations, tailored specifically for business owners like you. Learn how to effectively manage your financial responsibilities with practical strategies that cover local tax compliance, deductions, and comprehensive financial planning. Discover how to optimize your tax strategies and ensure your business thrives in Michigan's unique financial environment.

CLICK HERE TO READ THE FULL ARTICLE »

-

5 Reasons To Hire A Professional Tax Accountant

Managing finances and navigating the complex world of taxes can be daunting for businesses and individuals. In Michigan, where economic activities are diverse, and tax regulations are frequently updated, the need for professional tax guidance has never been more critical. This is particularly true in areas like Detroit and Ann Arbor and smaller communities like Allen Park. For residents and businesses in these areas, hiring a professional tax accountant isn't just a convenience—it's a strategic necessity.

CLICK HERE TO READ THE FULL ARTICLE »

-

What is Retirement Planning? Importance & Benefits

Retirement planning is crucial to financial security, yet it often remains overlooked until it is too late. For business owners and professionals in Michigan, understanding the importance of early and effective retirement planning can be the difference between a comfortable retirement and financial uncertainty in later years. This blog aims to demystify retirement planning, highlighting its significance and benefits to individuals and business owners.

CLICK HERE TO READ THE FULL ARTICLE »

-

Why is the Payroll Process Important for Any Organization?

Understanding the significance of an efficient payroll system is crucial for any business, especially those operating in the dynamic environments of Detroit, Troy, and surrounding Michigan. The payroll process does more than ensure employees are paid on time; it is deeply intertwined with an organization's overall financial health and regulatory compliance.

CLICK HERE TO READ THE FULL ARTICLE »

-

Season’s Greetings from Michigan Business & Personal Tax Center

Happy Holidays from Michigan Business & Personal Tax Center. Wishing you a joyous and safe holiday season, and a Happy New Year!

CLICK HERE TO READ THE FULL ARTICLE »

-

How Michigan Business & Personal Tax Center Helped A Client With Tax Insurance Liabilities

At Michigan Business & Personal Tax Center, we are passionate about reading the federal tax code, which can be fascinating and challenging at the same time. LOL!

CLICK HERE TO READ THE FULL ARTICLE »

-

Why You Shouldn’t DIY Complex Business and Tax Issues

We live in a specialized world, and I promise you, doing everything alone will only get you so far!

CLICK HERE TO READ THE FULL ARTICLE »

-

Season’s Greetings From Michigan Business & Personal Tax Center

The Michigan Business & Personal Tax Center team wishes you the happiest of holidays this season. May the New Year be filled with joy, health, and prosperity!

CLICK HERE TO READ THE FULL ARTICLE »

-

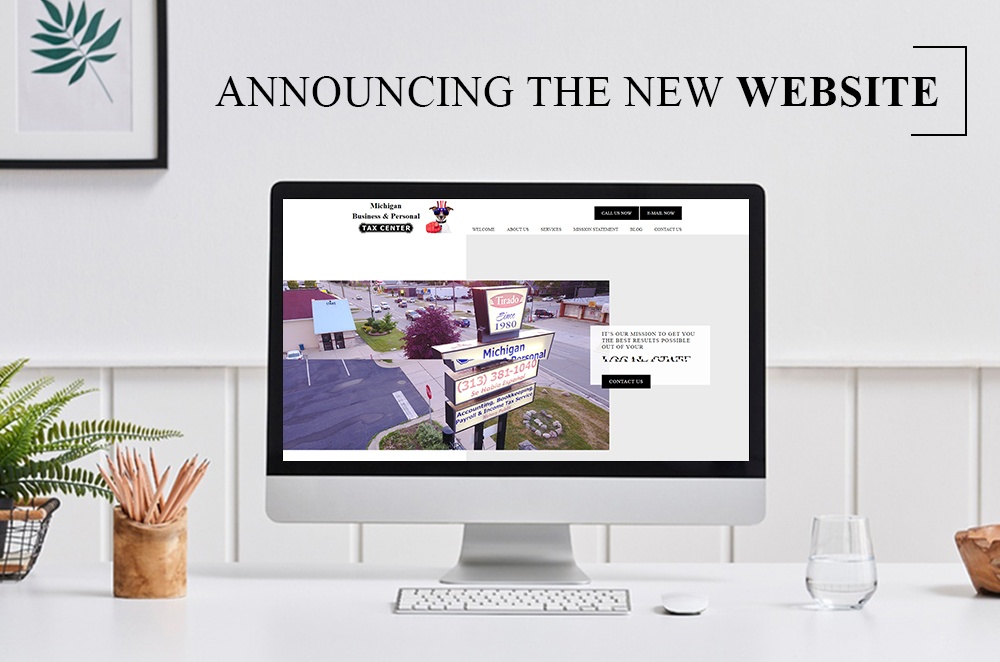

Announcing The New Website

-

New Website Under Construction